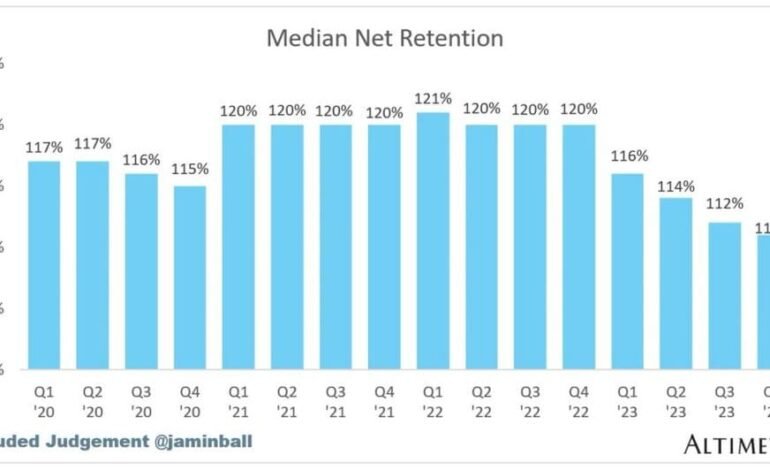

Median NRR is Still Over 110%. But it’s Fallen to Multi-Year Lows.

[ad_1]

So Jamin Ball’s Take on Public Company NRR

Jamin Ball from Altimeter provided an insightful summary of public company Net Revenue Retention (NRR) trends. You can see his analysis here.

While NRR has been decreasing since Q4’22 and is now lower than Q1’20, it still remains above 110% across the board. This highlights that the engine of 100%+ NRR for most public SaaS companies is still operational. Although 110% NRR is impressive, it falls short of the 120% threshold.

A notable example is Snowflake, where NRR has decreased from 170% to 130%, showcasing a slight decline.

The primary reason for this decline is often attributed to contraction rather than churn in many B2B SaaS companies. This involves customers reducing seat numbers and managing expenses efficiently. Explore this topic further with Henry Schuck, the CEO of ZoomInfo in this deep dive.

While facing a challenging landscape with a general -10% decrease in NRR, it’s crucial to remain optimistic and focus on long-term growth. In SaaS, customers tend to increase their spending each year if nurtured properly. Despite potential short-term hurdles, the upward trend continues.

Invest in this trend and embrace the journey. For more insights, check out this related post: High NRR Can Scale Infinitely. Invest More There.