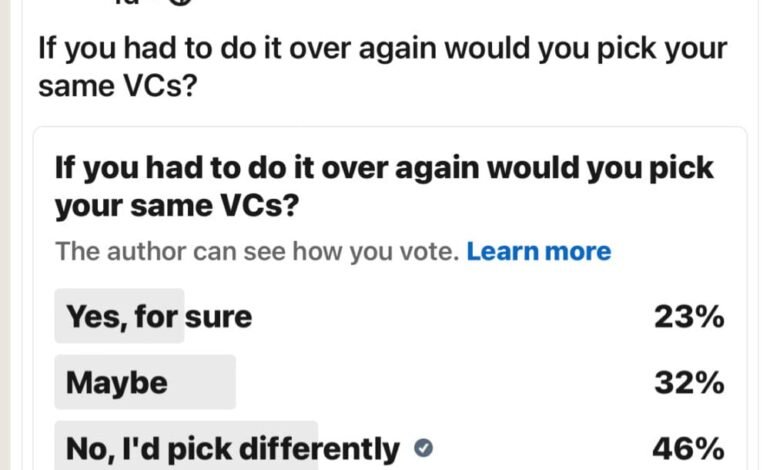

Only 23% of You Would Pick The Same VCs Again

[ad_1]

Survey Results: Would Founders Pick the Same VCs Again?

Recently, we conducted a survey at SaaStr to determine if founders would choose the same VCs if given the chance to start over. The findings were quite interesting – only 23% of respondents were certain they would pick the same VCs again.

While the poll results shed light on this topic, there are deeper nuances to the relationship between investors and founders. Despite aligned interests, frictions can arise due to various reasons:

- Some founders exhibit excessive spending habits, especially during the years 2020-2022.

- Expecting VCs to bail them out in times of trouble is a common mistake among some founders.

- Patronizing behavior from VCs can be off-putting to many founders.

- VCs manipulating outcomes, such as pushing founders to make certain decisions, can strain the relationship.

Although founders bear the brunt of these tensions, they may also be at fault in some instances. This leads to a sense of regret among many founders who have previously raised funds.

#1. Slow Down the VC Process Slightly if Multiple Offers are on the Table

Take a bit of extra time before making a decision on which VC to partner with. It’s okay to have additional meetings and discussions before committing to a long-term partnership.

#2. Trust Matters – Be Cautious of Overly “Nice” Behaviors and Sales Tactics

Once a VC expresses interest in a deal, their approach may shift towards sales tactics. It’s essential to be wary of overly friendly gestures and prioritize trust and alignment.

#3. Practice Transparency

VCs are equipped to handle both positive and negative news. Hiding important information from VCs during and after fundraising can damage the relationship irreparably. Transparency is key.

#4. Stay Informed

Many VCs share valuable insights through blogs, tweets, podcasts, etc. Being well-informed about their perspectives and values can help founders make better decisions.

#5. Conduct Reference Checks Thoughtfully

When checking references for VCs, consider the source and context of the feedback. Seek input from successful portfolio companies to gain a comprehensive understanding.

#6. Acknowledge VCs’ Perspectives

While most VCs approach their role as a job, some may deeply invest in the mission and journey of founders. Founders should be mindful of unintentionally causing rifts in relationships and understand the importance of mutual respect.

For further insights on choosing the right lead VC, check out our related post:

10 Criteria To Use To Pick Your Lead VC. If You Have Options.